FAQs

What is a BID?

A Business Improvement District (BID) is a designated area where businesses pay an additional levy to fund projects that enhance the district. BIDs are governed by legislation, specifically the Business Improvement Districts (England) Regulations 2004, and Sheffield BID is one of over 345 BIDs operating in the UK.

Is the BID unique to Sheffield?

No, a BID is a scheme developed in accordance with the Business Improvement District (England) Regulations 2004, within which businesses and other stakeholders contribute a levy determined by a prescribed formula. This creates a fund to address impediments to growth and improve the trading environment in which they operate.

There are currently more than 345 BIDs operating in towns and cities across the UK.

There are currently more than 345 BIDs operating in towns and cities across the UK.

Who can set up a BID?

A BID can be proposed by any non-domestic ratepayer, property owner, local authority, or other stakeholder with an interest in the BID area.

How is a BID created?

A BID is created through a ballot of businesses that would be liable to pay the mandatory levy. The ballot is conducted by the local authority (the Ballot Holder). There is no minimum turnout threshold, but the BID proposal must meet two criteria:

- A simple majority of those voting must be in favour.

- The aggregate rateable value of premises voting in favour must exceed the aggregate rateable value of premises voting against.

What is the purpose of a BID?

The purpose of a Business Improvement District (BID) is to enhance the business environment within a specific area. This is achieved by funding and implementing projects that address local challenges, improve infrastructure, and promote economic growth.

The BID focuses on creating a vibrant, attractive, and thriving area for businesses, residents, and visitors. The projects are funded through a levy paid by businesses within the BID area, ensuring that the initiatives directly benefit those who contribute.

The BID focuses on creating a vibrant, attractive, and thriving area for businesses, residents, and visitors. The projects are funded through a levy paid by businesses within the BID area, ensuring that the initiatives directly benefit those who contribute.

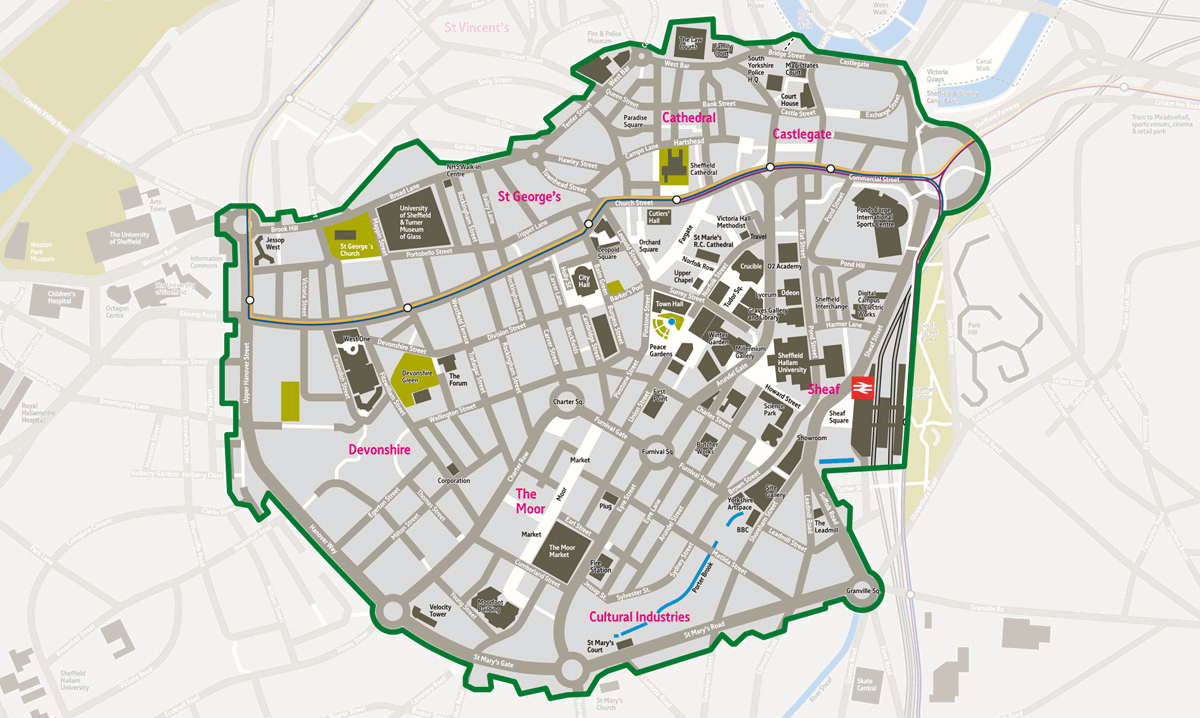

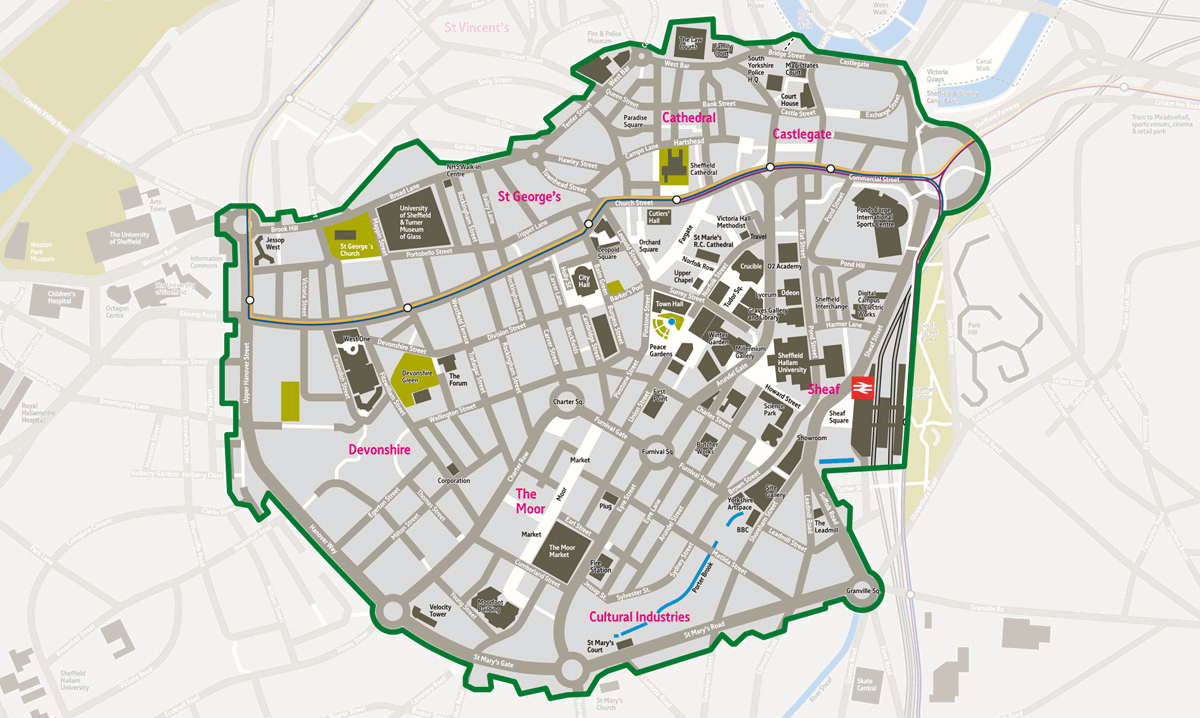

What is the BID area?

The Sheffield BID area, also referred to as the BID boundary, is currently based on the former inner city ring road as shown on the BID area map. The map below is the current boundary:

In our third term, which commences 1 April 2026, the BID boundary has been extended. See here for details.

In our third term, which commences 1 April 2026, the BID boundary has been extended. See here for details.

Who approves a BID?

The Local Government Act 2003 gave local authorities in England & Wales the power to approve the formation of a BID (if a majority of local businesses agree) and to collect the BID levy that will fund improvements.

What is the BID levy?

The BID levy is a legal charge payable by businesses within the defined boundary of the BID. It is based on the rateable value of the property and is used to fund projects that enhance the business environment in the BID area. The levy amount is determined to ensure it is fair and manageable for businesses, while providing sufficient funds to support impactful initiatives.

Who pays the levy?

The person or organisation liable to pay the business rates for the property is also responsible for paying the BID levy if the property has a rateable value of £40,000 or more. For occupied properties, this will be the occupier. For empty properties, this will typically be the leaseholder or the property owner.

How is the levy calculated?

The levy is calculated annually using the 2017 rateable value of the property for this current BID term, which runs until 31 March 2026. Future rating revaluations are not considered unless a property appears for the first time in a future rating list.

An annual bill is issued in April for the period from 1 April to 31 March.

In the third term (commencing 1 April 2026), the BID arrangement will transition to the 2023 rateable value of the property. Again, no future rating revaluations will be considered unless a property appears for the first time in a future rating list. The annual billing period of 1 April will be same.

An annual bill is issued in April for the period from 1 April to 31 March.

In the third term (commencing 1 April 2026), the BID arrangement will transition to the 2023 rateable value of the property. Again, no future rating revaluations will be considered unless a property appears for the first time in a future rating list. The annual billing period of 1 April will be same.

Who collects the BID levy?

Under BID regulations, Sheffield City Council is the billing authority responsible for collecting the Sheffield BID levy. The levy income is collected each year in a single instalment and kept in a separate ring-fenced account. It is then transferred to Sheffield BID based on the terms outlined in an operating agreement.

Sheffield City Council charges a collection fee for this service. Additionally, Sheffield BID incurs summons and liabilities costs when chasing non-payers, and provision for these costs is made in the annual budget. The collection of the BID levy carries the same enforcement weight as the collection of business rates.

Sheffield City Council charges a collection fee for this service. Additionally, Sheffield BID incurs summons and liabilities costs when chasing non-payers, and provision for these costs is made in the annual budget. The collection of the BID levy carries the same enforcement weight as the collection of business rates.

How long does the BID last?

Once balloted, the term of the BID runs for a maximum of five years. To continue its activities beyond this period, the BID must seek a renewal ballot or propose a new business plan through a new ballot. Sheffield BID is in its second term which runs from 1 April 2021 to 31 March 2026. It is proposing a third term which would run from 1 April 2026 through a ballot to be held 19 September to 16 October.

What is the Council's role in the BID?

In accordance with the Business Improvement Districts (England) Regulations 2004, the Council is by law the billing authority for any BID in Sheffield, which means it is responsible for the collection of BID levies. It is not responsible for providing the BID services because there is an independent accountable delivery body - Sheffield City Centre BID Limited ("Sheffield BID").

Why is the levy only mandatory on premises with an RV of £40,000 or more?

BIDs can set a minimum threshold to ensure the number of liable premises is manageable and to exclude non-trading entities. Sheffield BID is mindful of the hereditaments that are excluded, particularly where small businesses in key streets make up the fabric of a community, but voluntary levies paid directly to Sheffield BID through associate membership is an option for businesses below the threshold.

How much BID levy is collected for Sheffield BID?

Over this current five-year term, approximately £3.2 million is collected through the Sheffield BID levy. The new arrangement for a third term (commencing 1 April 2026) will collect approximately £6m over five years.

I am eligible for rates relief - will I still have to pay my BID levy?

Yes, even if you are eligible for rates relief, you are still required to pay the BID levy. The BID levy is separate from business rates and applies to all eligible properties within the BID area, regardless of any rates relief.

Are there any caps on the BID levy?

Yes, BID legislation allows BIDs to set a maximum amount that any levy payer will pay. For Sheffield BID's current term, the maximum payment for a single property is £18,000 (rising to £20,000 in the third term). For businesses operating multiple properties under the same trading name, if their annual combined BID levy liability exceeds £40,000, their total contribution is capped at this amount (rising to £45,000 in the third term).

Do the Council and other public sector bodies pay the BID levy?

Yes. Sheffield City Council and the public bodies must pay the levy on premises within the BID area for which they are liable to pay business rates.

Can I opt out of the BID?

No. The BID is legally binding on all eligible business ratepayers in the BID area.

Does every business pay the BID levy?

Businesses occupying premises with a rateable value of £40,000 or more pay the BID levy. Premises classified for business rate purposes as hospitals, schools or hotels are exempt from the BID levy.

Why are hotels exempt?

Hotels are part of the tourism visitor economy. Delivering high-quality tourist-related services and effectively marketing and promoting destinations to retain visitors from within the UK and attract tourists from overseas requires a different funding model. Therefore, hotels are exempt from the BID levy.

What happens to the money collected through the levy?

This levy is used to develop projects which will benefit businesses in the local area. There is no limit on what projects or services can be provided through a BID. The only requirement is that it should be something that is in addition to services provided by local authority.

Aren’t these services already provided by the Council?

No. By law a BID must provide either additional services not already provided by the Council, or it must provide enhancements to existing services.

I won’t benefit from BID services, why should I pay?

The BID levy is a charge payable by law and not a payment for services received. If you have an enquiry about how you can benefit directly from BID services, please get in touch with the BID office.

I voted against the BID or wasn’t eligible to vote at the time of the ballot. Do I still have to pay?

Yes. The result of a BID ballot is binding on all eligible business ratepayers in the BID area for the BID term. This includes persons or organisations who become ratepayers after the date of the ballot.

Is there an increase in the BID levy each year?

Not within the current term, but provision has been made within the third term BID rules for an annual 3% inflationary increase.

The property is unoccupied, do I still need to pay?

Yes. The ratepayer for an unoccupied property is also liable to pay the BID levy. This is usually the landlord or property owner.

Can I pay by instalments?

The BID levy is payable in one sum due on 1 April each year or 14 days after the issue of the levy demand notice whichever is the latter. It may be possible to agree a payment plan with Sheffield City Council by contacting bidcollection@sheffield.gov.uk.

What should I do if I can’t pay?

Discretionary hardship relief is available. If you have genuine financial difficulty and are unable to pay, then you should contact the Council at bidcollection@sheffield.gov.uk as soon as possible.

What happens if I pay for the year then cease to be liable?

Whoever is listed as the ratepayer at the time the annual bills are issued remains responsible for the BID levy for the whole year. No refunds will be issued. However, if you move into a property part way through the BID’s financial year, you will not have to pay until the next bills are issued.

What is Sheffield City Centre BID Limited?

This is the accountable body for delivery of the city centre BID. The Company is a not-for-profit private company limited by guarantee with a board of non-executive directors drawn from businesses who pay the BID levy. This Company was appointed as the BID body through the first ballot process in March 2015.

Who do I contact with an enquiry about the BID?

Once you receive a bill, if your enquiry is about payment or the amount you are charged, then you should contact the Council (bidcollection@sheffield.gov.uk). However, if your enquiry is about BID services or anything other than payment you should contact Sheffield BID. Email: enquiries@sheffieldbid.com or telephone: 0114 339 2015.